BRICS Currency | De-Throning The US-Dollar

- Categories International Relations & Business

BRICS Currency

There is talk of de-dollarization. In New Delhi last month, Deputy Speaker of the Russian Duma Alexander Babakov said Russia is now leading the development of a new currency. It is intended that he will be used by the BRICS countries for cross-border trade.

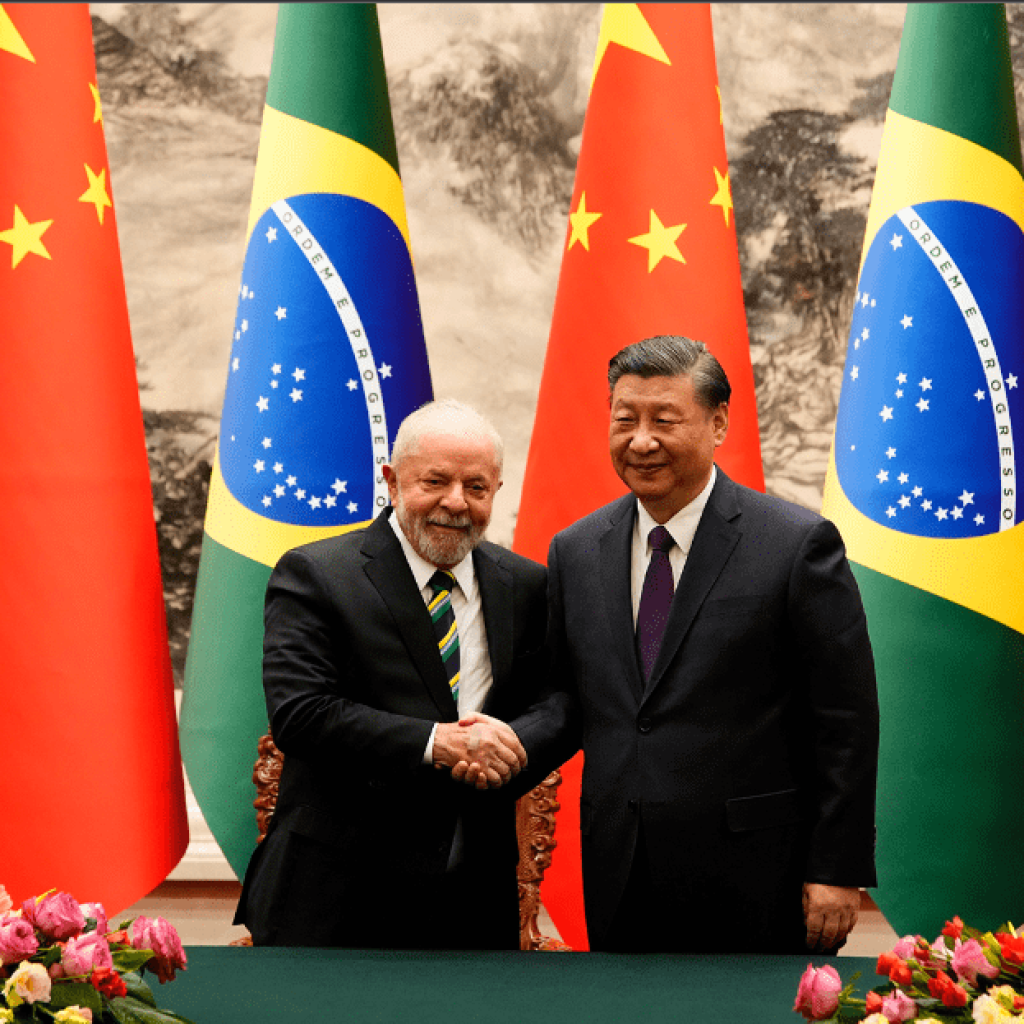

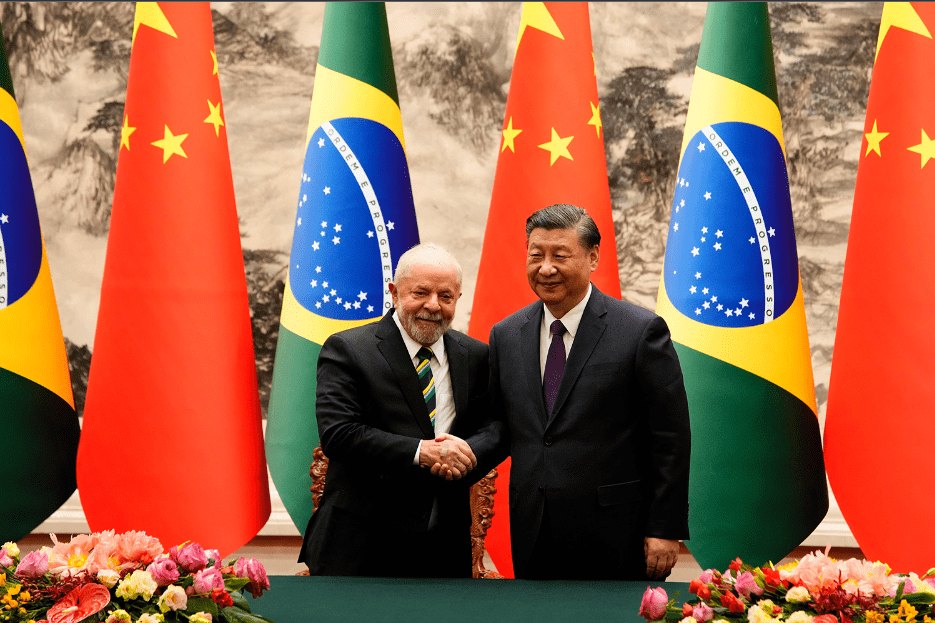

Brazil, Russia, India, China, South Africa. A few weeks later, Brazilian President Luis Inacio Lula da Silva intervened in Beijing. “Every night,” he wonders, “why should all countries base their trade on the dollar?”

These developments complicate the explanation for the steady dominance of the dollar in countries with blind individual competitors like the euro, yen, and renminbi, as the dollar is a one-eyed currency.

As one economist put it, “Europe is a museum, Japan is a nursing home, China is a prison.” He is not wrong. But the currency issued by BRICS is different. It is a new breed of growing dissatisfaction that outnumbers not only the current hegemon but also the entire G-7 weighted class combined, in terms of gross domestic product. It’s like a coalition.

Foreign governments looking to move away from reliance on the US dollar are nothing new. Since the 1960s, rumors of an attempt to usurp the dollar throne in foreign capitals have made headlines. But the conversation has yet to yield results. For one, dollars are now used in 84.3% of cross-border transactions.

In comparison, the Chinese yuan is only 4.5%. And the Kremlin’s habitual use of lies as a tool of state policy has created skepticism about whatever Russia says. The answers to many practical questions, such as the extent to which other BRICS nations of his will agree with Babakov’s proposal, remain unclear for the time being.

Nevertheless, the potential for success of BRICS-issued currencies is new, at least from an economic point of view. Planned as early as this, and many practical issues remain unresolved, such a currency could replace the US dollar as the reserve currency for BRICS members. Unlike previously proposed competitors like the digital yuan, this fictitious currency could actually usurp, or at least shake, the dollar’s throne.

If the BRICS only uses the Bric for international trade, it would remove the obstacles that currently frustrate their efforts to escape dollar hegemony. Today, these efforts often take the form of bilateral agreements denoting trade in currencies other than the dollar, such as the renminbi, which is now the primary trading currency between China and Russia.

Obstacles of BRICS Currency

Russia is not ready to source the rest of its imports from China. After bilateral transactions between the two countries, Russia tends to deposit proceeds in dollar-denominated assets and buy remaining imports from the rest of the world.

But if China and Russia each used only bricks for trade, Russia would no longer need to store the proceeds of bilateral trade in dollars.

After all, Russia would buy its remaining imports in bricks, not dollars. right. Finally entered the de-dollarization.

Is it realistic to imagine the BRICS only using crap for trading?

Yes. First of all, they were able to cover all import bills themselves. In 2022, the BRICS recorded an overall trade surplus of US$387 billion, also known as the balance of payments surplus, largely thanks to China.

The BRICS are also poised to achieve a level of self-sufficiency in international trade that no other monetary union in the world has achieved. The BRICS monetary union, unlike its predecessors, does not share borders, so its member states have the potential to produce a wider range of commodities than any existing monetary union.

Artifacts of geographic diversity represent the door to levels of self-sufficiency that have easily escaped monetary unions defined by geographic concentration, such as the Eurozone with its $476 billion trade deficit in 2022.

But BRICS don’t even have to trade only with each other. Each member of the BRICS group is an economic powerhouse in its respective region, so countries around the world will be willing to do business in BRICS countries.

Even if Thailand were forced to use BRICS in its trade with China, Brazilian importers could buy shrimp from Thai exporters and keep Thai shrimp on Brazilian menus.

Goods manufactured in one country can also be exported to and then re-exported from a third country to circumvent bilateral trade restrictions. As a result of new trade restrictions.

If the United States boycotted bilateral trade with China instead of the brick trade, their children could continue to play with Chinese toys that were exported to countries such as Vietnam and then to the United States.

Diversity and Inclusion in the Sports Ecosystem: Why is it Important

Previous post